Mastering CoinSpot: Login, Trading Strategies, and Techniques

With its intuitive interface, diverse range of supported cryptocurrencies, and commitment to security, CoinSpot has emerged as a trusted destination for both novice investors and seasoned traders.

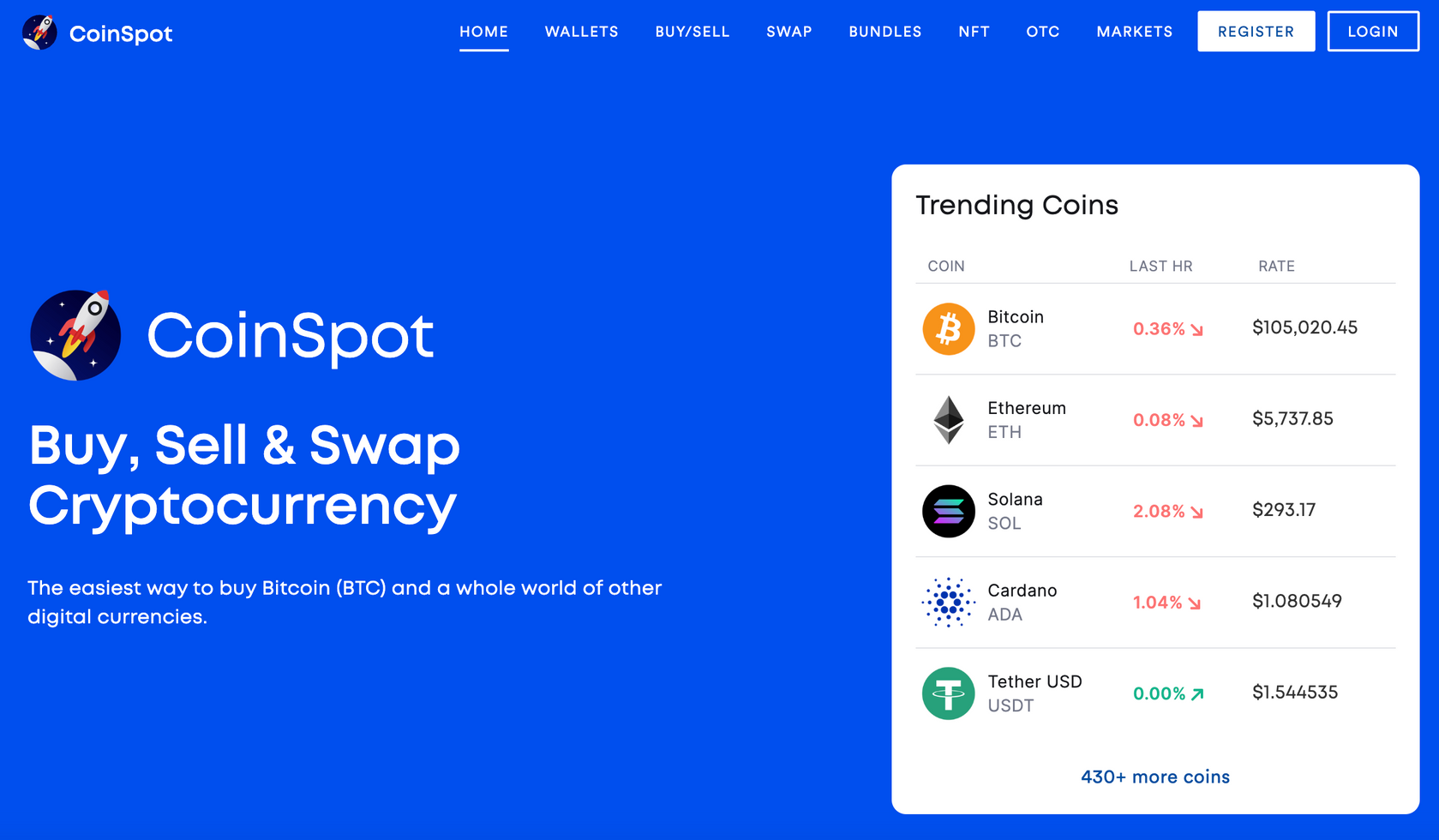

CoinSpot Login Process:

Accessing your CoinSpot account is a straightforward process designed to ensure ease of use and security. To log in, visit the CoinSpot website and locate the "Login" button at the top right corner of the homepage. Enter your registered email address and password in the provided fields, then click "Login" to access your account dashboard. If you've enabled two-factor authentication (2FA) for added security, you'll be prompted to enter the code generated by your authenticator app or sent to your mobile device.

Trading Strategies and Techniques On Coinspot Login:

Successful cryptocurrency trading requires a solid understanding of market dynamics, as well as effective strategies and techniques to capitalize on price movements. Here are some key strategies and techniques to consider when trading on CoinSpot:

- Market Analysis: Before executing trades, conduct thorough market analysis to identify trends, patterns, and potential opportunities. Utilize technical analysis tools such as candlestick charts, moving averages, and support/resistance levels to analyze price movements and make informed trading decisions.

- Diversification: Diversification is a fundamental strategy for managing risk and maximizing returns in cryptocurrency trading. Spread your investments across multiple cryptocurrencies and asset classes to reduce exposure to individual market fluctuations and mitigate potential losses.

- Risk Management: Implement effective risk management techniques to protect your capital and minimize downside risk. Set stop-loss orders to automatically sell a position if it reaches a predetermined price level, and establish profit targets to lock in gains and avoid greed-driven decisions.

- Hodling vs. Active Trading: Consider your trading style and objectives when developing a strategy. Hodling (holding onto assets for the long term) may be suitable for investors with a bullish outlook on specific cryptocurrencies, while active trading involves frequent buying and selling to capitalize on short-term price movements.

- Emotional Discipline: Emotions can cloud judgment and lead to impulsive decisions in trading. Maintain emotional discipline by sticking to your trading plan, avoiding FOMO (fear of missing out), and refraining from making rash decisions based on market volatility or noise.

- Continuous Learning: The cryptocurrency market is constantly evolving, so it's essential to stay informed and continuously educate yourself about new developments, trends, and trading strategies. Engage with online resources, participate in trading communities, and learn from both successes and failures to refine your trading approach over time.

Conclusion:

CoinSpot offers a comprehensive platform for cryptocurrency trading, with features designed to cater to the needs of users at all experience levels. By mastering the login process, implementing effective trading strategies, and utilizing proven techniques, users can navigate the cryptocurrency market with confidence and increase their chances of success.